"Odious Debt"

Description

There is a legal concept in international law known as odious debt, also sometimes referred to as illegitimate debt. It states that debts incurred by a despotic regime are not considered enforceable or binding on the citizens of a country or on its successor state once that despotic regime is deposed.

The core idea behind this legal concept is that if a regime borrows money for personal gain or against the interests of its people, and if creditors knew this at the time (or should have known), then this debt is not binding, and the lenders go home empty-handed. In other words, lenders need to do more than just gauge the solvency of a nation before issuing debt or issuing loans based solely on whether a regime is capable of squeezing the necessary taxes out of its population to service those debts — this legal concept is meant to raise the bar by threatening consequences against international creditors who knowingly underwrite exploitative, predatory, or despotic governments that do not act in the best interests of their citizens. That overhanging threat against international creditors is meant to strengthen society’s immune system against repressive or irresponsible government.

Of course, if that threat actually had teeth, there would be very few countries left today still capable of accessing the bond markets out of fear of this legal concept being applied, in full or in part, since it’s crystal clear by now that corruption, wilful incompetence, and grift have completely overwhelmed even the most Western of Western nations, and that citizens have little recourse to hold their leaders accountable as the “new crook” that’s voted in merely picks up where the “old crook” left off. And yet, bond investors keep these regimes solvent nonetheless, year after year, and decade after decade.

“Thieves of private property pass their lives in chains; thieves of public property in riches and luxury.”

― Cato the Elder

In reality, to invoke the legal concept of odious debt, long-suffering citizens would first have to depose the despotic regime. Then they would have to make their case in a sympathetic international court — an almost impossible task, though not without precedent as you will see momentarily. And, rather cynically, the geopolitical context surrounding the claim (i.e. which other countries will be affected by this debt forgiveness and what geopolitical agendas will be served (or violated) by that debt forgiveness) is actually far more influential on whether that claim sticks than the sins committed by the despotic nation itself. Contrary to popular belief, international law is neither impartial nor blind, but is wholly shaped by the priorities, biases, and agendas of those with the power to enforce it.

Furthermore, the world’s financial institutions would fight tooth and nail against any declaration of odious debt because if countries learn to walk away from their debts every time a new administration figures out how to blame the problems it inherits on a previous corrupt administration, the world’s bond markets would immediately seize up as investors find somewhere safer to park their money, with apocalyptic near-term consequences for our debt-fueled interconnected global economy.

Indeed, no matter how deserving a nation’s claims may be, in order to successfully enforce this claim of odious debt against international creditors, claimant nations may need an army strong enough to fend off a foreign army if creditor nations decide to send their armies to collect — which is historically what used to happen anytime any country tried to walk away from its debts, even when those debts had been thrust upon them by illegitimate means. Once again, this scenario is also not without precedent, as you will also see momentarily.

Even at the individual scale, debt is a form of bondage. But on an international scale, with entire nations funding their activities with foreign loans, the collections’ agency is another nation’s army. International justice is not and can never be blind because everyone in the court is also a participant in that international financial system and thus has their own axe to grind (and their own vulnerabilities to protect) as they weigh one another’s claims.

This reality raises uncomfortable questions about the wisdom of funding a nation with foreign debts, as has become the norm in our modern era. As long as a nation relies only on its own citizens to fund its government, a despotic regime can be starved out of existence simply by refusing to buy bonds and pay taxes — not easy, but also not impossible because ultimately even goon squads need to be paid.

But international lending breaks that cycle of accountability by breathing fresh life into despotic regimes. And once those debts are issued, a nation can continue to be held in debt bondage for generations, long after the despotic regime that incurred those debts has collapsed or been overthrown because the threat of invasion or financial collapse continues to hang over the people if they do not continue to toil in service of those foreign debts.

A classic example is Haiti, whose slave population won its freedom from France in 1791 by violent revolution. But in 1825, France sent its gunboats to Haiti and threatened to invade unless Haiti agreed to pay reparations for the loss of France’s property, including the loss of its slaves. In Haiti’s case, unlike the examples provided later in this essay, the concept of “odious debt” never kicked in to relieve Haiti of its debts to France. In late 19th and early 20th century Mexico, Cuba, Costa Rica, and elsewhere, the U.S. was happy to invoke the principle of odious debt (or some earlier version of it) in order to strategically leave European creditors empty-handed. Debt forgiveness was a strategic play to encourage European to remove their fingers out of America’s sphere of influence. But in Haiti’s case things played out a little differently… with the U.S. playing the role of enforcer of those odious debts rather than stepping into the role of the benevolent saviour to relieve Haiti of those odious debts, quite in contrast to what the U.S. did in Mexico, Cuba, Costa Rica, etc. Geopolitical context is everything.

It took 122 years (!) for Haiti to crawl out from underneath that odious debt to France (from 1825 to 1947). Haiti even had to take fresh loans from French banks to service that indemnity, thus relying on new debt to service that old debt (as a point of clarification, technically Haiti finished paying out reparations to France by 1888, but the colossal loans that Haiti had to take out from French banks to pay out those reparations to the French government took until 1947 to pay off).

By 1900, 80% of Haiti’s budget was being consumed to service these debts (with much of the remainder pilfered by the despotic regimes that rose and fell in quick succession across this entire time period). In a sane (and fair) world, those odious debts should have been wiped off the slate even as Haiti should simultaneously also have been barred from receiving any fresh loans considering the disastrous track records of the brutal and corrupt regimes that followed in quick succession one after the other, usually by violent revolution. That combination of forgiveness of odious debt and no more new loans to corrupt existing regimes would have created the incentives for a new fiscally responsible and less despotic system of government to emerge in Haiti. But it didn’t — instead Haiti was trapped in a cycle of debt slavery, with one despot after another maintaining business as usual on the back of foreign loans.

After the end of the U.S. Civil war in 1867, the U.S. (through its Wall Street connections) took over the Haitian financial system when U.S. banks bought the Haitian national bank and the U.S. army seized Haiti’s gold reserves for safekeeping. By this move, America became Haiti’s primary creditor. By restructuring and consolidating Haiti’s debts, the U.S. effectively took control of Haiti’s financial obligations even as it redirected Haiti’s ongoing debt service payments to the benefit of American financial institutions, particularly the National City Bank (predecessor to today’s Citibank).

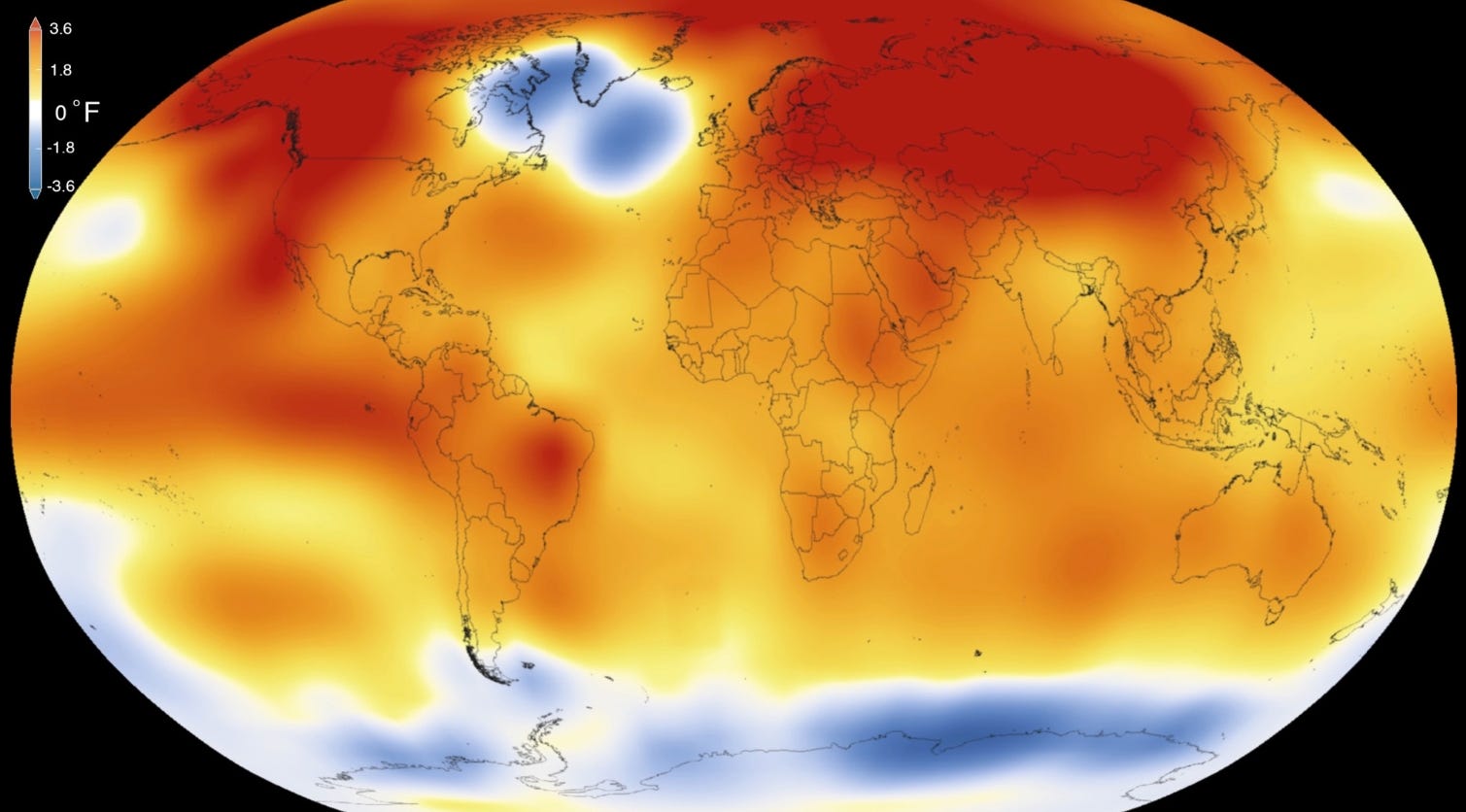

In doing so, the U.S. successfully wrestled Haiti out of European control and into its own orbit of control. You only have to glance at a world map to understand why Haiti (sitting right beside Cuba and just south of America’s southeastern seaboard), is a core American concern. That map view makes it amply clear why America sought to expel European powers out of its sphere of influence, including from Haiti, as demanded by its Monroe Doctrine, established in 1823 by President James Monroe. That doctrine declared that the Western Hemisphere was off-limits to further European colonization or intervention; it has been a core guiding U.S. foreign policy imperative ever since.

But with Haiti’s debt payments now funneling through U.S. banks rather than going directly into foreign hands, debt forgiveness was off the table. So much so that in 1915, President Woodrow Wilson invaded and occupied Haiti for 19 years. The invasion was excused as necessary in order to restore order in a rapidly deteriorating political situation because an angry mob had just lynched the latest Haitian president. But the occupation was also clearly a move to prevent Haiti from defaulting on U.S. loans and to protect U.S. investments. And behind the scenes, the move was clearly a strategy to exclude other European powers from establishing any further strongholds on the island. By 1915, with WWI already underway, Germans had long since figured out how to get around Haiti’s foreign land ownership restrictions by intermarrying with Haitians — by 1915